Futures Markets and Commodity Trading Advisors

The Backbone

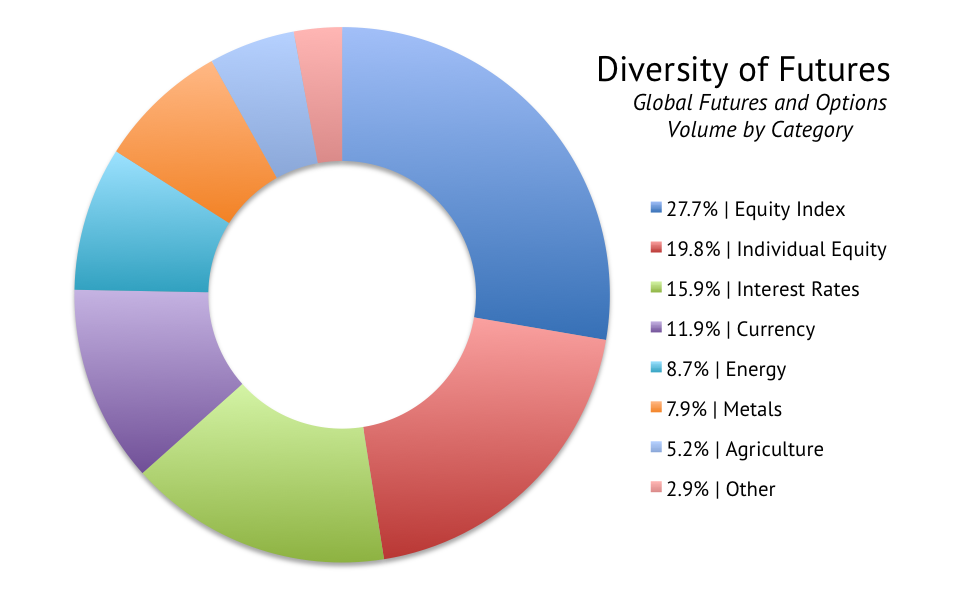

Commodity Trading Advisors (CTAs) are the backbone of the Managed Futures industry. But what do they actually use to generate their performance? How do they actually create value? The answer is found in the futures markets. CTAs have access to a diverse array of futures and options markets. See the image below for a quick overview of these markets.

The above illustrates the percentage of contracts traded and/or cleared at 78 exchanges worldwide Jan-Dec 2017. Data FIA 2017.

Benefits of Futures Markets

Most futures markets are very broad and liquid. Futures are highly leveraged investments. Leveraged investing amplifies profits and risks, and it allows CTAs to use your capital efficiently. For some investors, there are tax advantages with futures. An additional unique advantage, in our opinion, is the ability to establish a short position just as easily as you can a long position. While this doesn’t increase your chances for profit, it gives the CTA more flexibility to work in any economic environment.

Most futures markets also have options contracts which can provide further opportunities for flexibility and risk management.

Commodity Trading Advisors

CTAs don’t need the price of markets to rise for them to generate returns! They manage their clients’ assets using proprietary trading strategies. The majority of these strategies are systematic trend following in nature, but you can find CTAs with all sorts of approaches to trading. In the past several years, money invested in Managed Futures has more than doubled and is estimated to continue to grow in the coming years especially when hedge fund returns flatten and stocks underperform.

Ascent has 300+ commodity trading advisors to choose from in our database. VIEW DATABASE

Past performance is not necessarily indicative of future results. Trading futures and options involve substantial risk of loss and are not suitable for all investors. There is no guarantee of profit. .